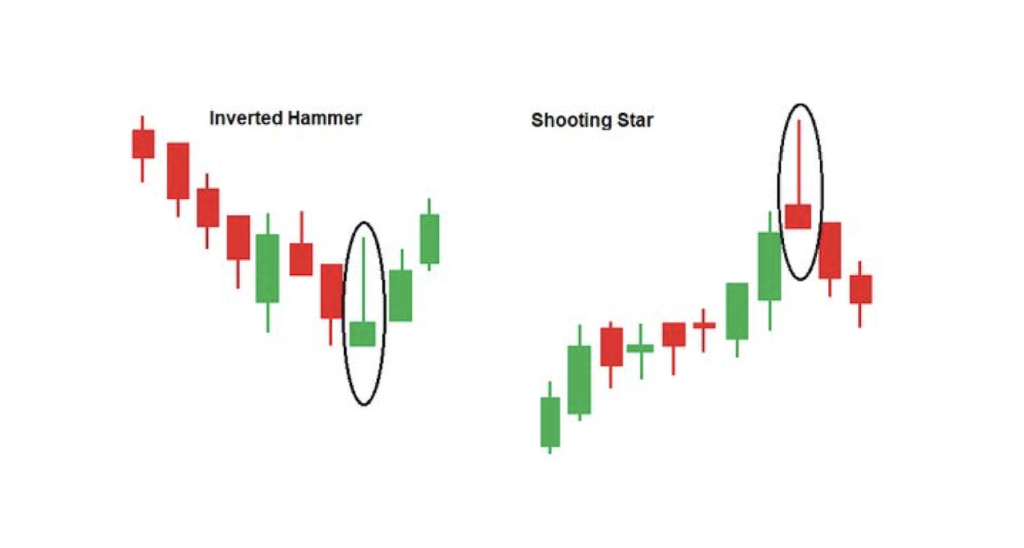

Hammer Chart Signal . the hammer is a single candlestick pattern that forms during a downtrend and signals a potential trend reversal. in this guide to understanding the hammer candlestick formation, we’ll show you what this chart looks like,. It consists of a small real body that emerges after a significant drop in price. the hammer candlestick pattern is a bullish candlestick that is found at a swing low. a hammer or inverted hammer candlestick pattern after an uptrend is likely exhaustion. After a downtrend, they signal potential. a hammer candlestick formation at a downtrend's end suggests potential trend reversal, often leading to upward price movement. a hammer candle is a popular pattern in chart technical analysis. The hammer signals that price may be about. Most traders go bullish when seeing this. It is characterized by a small body and a long.

from learn.bybit.com

It consists of a small real body that emerges after a significant drop in price. Most traders go bullish when seeing this. a hammer or inverted hammer candlestick pattern after an uptrend is likely exhaustion. the hammer candlestick pattern is a bullish candlestick that is found at a swing low. the hammer is a single candlestick pattern that forms during a downtrend and signals a potential trend reversal. After a downtrend, they signal potential. It is characterized by a small body and a long. a hammer candle is a popular pattern in chart technical analysis. a hammer candlestick formation at a downtrend's end suggests potential trend reversal, often leading to upward price movement. in this guide to understanding the hammer candlestick formation, we’ll show you what this chart looks like,.

How to Read the Inverted Hammer Candlestick Pattern? Bybit Learn

Hammer Chart Signal Most traders go bullish when seeing this. a hammer candle is a popular pattern in chart technical analysis. a hammer candlestick formation at a downtrend's end suggests potential trend reversal, often leading to upward price movement. a hammer or inverted hammer candlestick pattern after an uptrend is likely exhaustion. the hammer candlestick pattern is a bullish candlestick that is found at a swing low. It consists of a small real body that emerges after a significant drop in price. The hammer signals that price may be about. in this guide to understanding the hammer candlestick formation, we’ll show you what this chart looks like,. Most traders go bullish when seeing this. the hammer is a single candlestick pattern that forms during a downtrend and signals a potential trend reversal. It is characterized by a small body and a long. After a downtrend, they signal potential.

From learnpriceaction.com

Hammer Candlestick Pattern Trading Guide Hammer Chart Signal a hammer candlestick formation at a downtrend's end suggests potential trend reversal, often leading to upward price movement. the hammer is a single candlestick pattern that forms during a downtrend and signals a potential trend reversal. It consists of a small real body that emerges after a significant drop in price. a hammer or inverted hammer candlestick. Hammer Chart Signal.

From t-fx.blogspot.com

Hammer candlestick pattern Learn Forex Trading Hammer Chart Signal It consists of a small real body that emerges after a significant drop in price. a hammer candlestick formation at a downtrend's end suggests potential trend reversal, often leading to upward price movement. After a downtrend, they signal potential. the hammer is a single candlestick pattern that forms during a downtrend and signals a potential trend reversal. Most. Hammer Chart Signal.

From learn.bybit.com

How to Read the Inverted Hammer Candlestick Pattern? Bybit Learn Hammer Chart Signal a hammer candle is a popular pattern in chart technical analysis. It is characterized by a small body and a long. a hammer candlestick formation at a downtrend's end suggests potential trend reversal, often leading to upward price movement. It consists of a small real body that emerges after a significant drop in price. The hammer signals that. Hammer Chart Signal.

From www.asktraders.com

Hammer Candlestick Example & How To Use 2024 Hammer Chart Signal a hammer or inverted hammer candlestick pattern after an uptrend is likely exhaustion. Most traders go bullish when seeing this. the hammer candlestick pattern is a bullish candlestick that is found at a swing low. in this guide to understanding the hammer candlestick formation, we’ll show you what this chart looks like,. It consists of a small. Hammer Chart Signal.

From topfxmanagers.com

Hammer Candlestick What Is It and How to Use It in Trend Reversal Hammer Chart Signal a hammer candle is a popular pattern in chart technical analysis. After a downtrend, they signal potential. in this guide to understanding the hammer candlestick formation, we’ll show you what this chart looks like,. It consists of a small real body that emerges after a significant drop in price. a hammer or inverted hammer candlestick pattern after. Hammer Chart Signal.

From www.vrogue.co

Hammer Candlestick Pattern Trading Guide Candlestick vrogue.co Hammer Chart Signal a hammer candlestick formation at a downtrend's end suggests potential trend reversal, often leading to upward price movement. a hammer or inverted hammer candlestick pattern after an uptrend is likely exhaustion. a hammer candle is a popular pattern in chart technical analysis. After a downtrend, they signal potential. The hammer signals that price may be about. It. Hammer Chart Signal.

From www.vrogue.co

What Is A Hammer Candlestick Chart Pattern Litefinanc vrogue.co Hammer Chart Signal the hammer is a single candlestick pattern that forms during a downtrend and signals a potential trend reversal. It is characterized by a small body and a long. The hammer signals that price may be about. in this guide to understanding the hammer candlestick formation, we’ll show you what this chart looks like,. a hammer candle is. Hammer Chart Signal.

From learnpriceaction.com

Hammer Candlestick Pattern Trading Guide Hammer Chart Signal the hammer candlestick pattern is a bullish candlestick that is found at a swing low. It consists of a small real body that emerges after a significant drop in price. The hammer signals that price may be about. the hammer is a single candlestick pattern that forms during a downtrend and signals a potential trend reversal. After a. Hammer Chart Signal.

From www.litefinance.org

What is a Hammer Candlestick Chart Pattern? LiteFinance Hammer Chart Signal a hammer candle is a popular pattern in chart technical analysis. in this guide to understanding the hammer candlestick formation, we’ll show you what this chart looks like,. the hammer candlestick pattern is a bullish candlestick that is found at a swing low. The hammer signals that price may be about. After a downtrend, they signal potential.. Hammer Chart Signal.

From www.forexstrategiesresources.com

Hammer Trading System Forex Strategies Forex Resources Forex Hammer Chart Signal the hammer is a single candlestick pattern that forms during a downtrend and signals a potential trend reversal. the hammer candlestick pattern is a bullish candlestick that is found at a swing low. It consists of a small real body that emerges after a significant drop in price. in this guide to understanding the hammer candlestick formation,. Hammer Chart Signal.

From exoaqfbns.blob.core.windows.net

Hammer Chart Pattern Stocks at Theresa Bates blog Hammer Chart Signal the hammer candlestick pattern is a bullish candlestick that is found at a swing low. a hammer candle is a popular pattern in chart technical analysis. The hammer signals that price may be about. Most traders go bullish when seeing this. in this guide to understanding the hammer candlestick formation, we’ll show you what this chart looks. Hammer Chart Signal.

From libertex.com

Candlestick Hammer Bedeutung Identifizieren von Preisumkehrungen mit Hammer Chart Signal a hammer candlestick formation at a downtrend's end suggests potential trend reversal, often leading to upward price movement. It consists of a small real body that emerges after a significant drop in price. Most traders go bullish when seeing this. the hammer is a single candlestick pattern that forms during a downtrend and signals a potential trend reversal.. Hammer Chart Signal.

From www.forexschoolonline.com

Inverted Hammer Candlestick Pattern Quick Trading Guide Hammer Chart Signal a hammer or inverted hammer candlestick pattern after an uptrend is likely exhaustion. After a downtrend, they signal potential. It consists of a small real body that emerges after a significant drop in price. the hammer is a single candlestick pattern that forms during a downtrend and signals a potential trend reversal. Most traders go bullish when seeing. Hammer Chart Signal.

From br.pinterest.com

Hammer and Inverted Hammer patterns Candlestick patterns, Day trading Hammer Chart Signal a hammer candle is a popular pattern in chart technical analysis. in this guide to understanding the hammer candlestick formation, we’ll show you what this chart looks like,. It is characterized by a small body and a long. The hammer signals that price may be about. a hammer candlestick formation at a downtrend's end suggests potential trend. Hammer Chart Signal.

From www.reddit.com

HCANF ,New positiv Signal comes. Hammer chart. HALO COLLECTIVE r Hammer Chart Signal a hammer candle is a popular pattern in chart technical analysis. It is characterized by a small body and a long. in this guide to understanding the hammer candlestick formation, we’ll show you what this chart looks like,. a hammer or inverted hammer candlestick pattern after an uptrend is likely exhaustion. the hammer candlestick pattern is. Hammer Chart Signal.

From learnpriceaction.com

Hammer Candlestick Pattern Trading Guide Hammer Chart Signal It is characterized by a small body and a long. a hammer candlestick formation at a downtrend's end suggests potential trend reversal, often leading to upward price movement. in this guide to understanding the hammer candlestick formation, we’ll show you what this chart looks like,. After a downtrend, they signal potential. a hammer candle is a popular. Hammer Chart Signal.

From phemex.com

What is and How to Trade on a Hammer Candlestick? Phemex Academy Hammer Chart Signal the hammer is a single candlestick pattern that forms during a downtrend and signals a potential trend reversal. The hammer signals that price may be about. in this guide to understanding the hammer candlestick formation, we’ll show you what this chart looks like,. It is characterized by a small body and a long. a hammer candle is. Hammer Chart Signal.

From www.pinterest.com

What is a Hammer Candlestick Chart Pattern? NinjaTrader Blog in 2021 Hammer Chart Signal It consists of a small real body that emerges after a significant drop in price. It is characterized by a small body and a long. a hammer or inverted hammer candlestick pattern after an uptrend is likely exhaustion. in this guide to understanding the hammer candlestick formation, we’ll show you what this chart looks like,. The hammer signals. Hammer Chart Signal.